Navigating the UK Financial Year 2025: A Comprehensive Guide

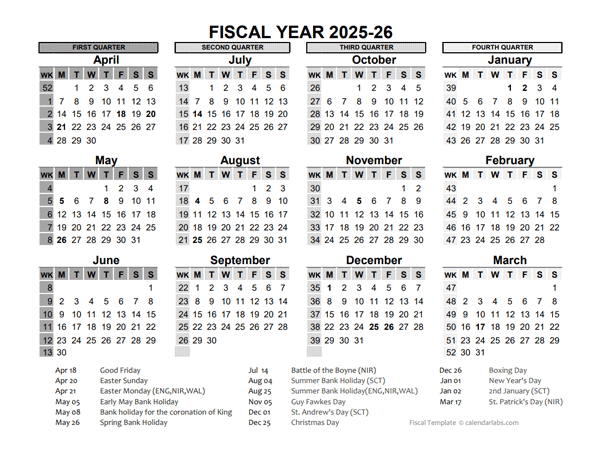

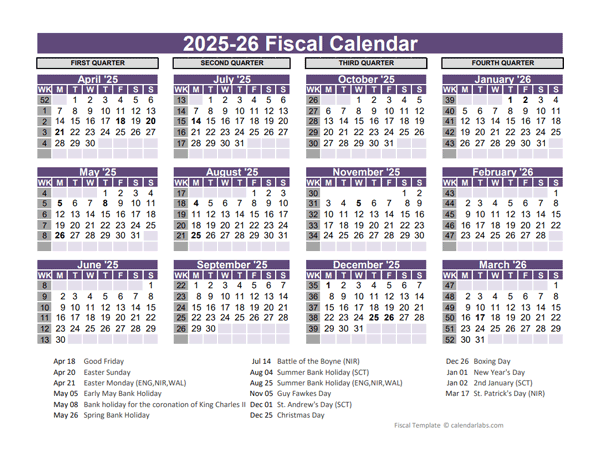

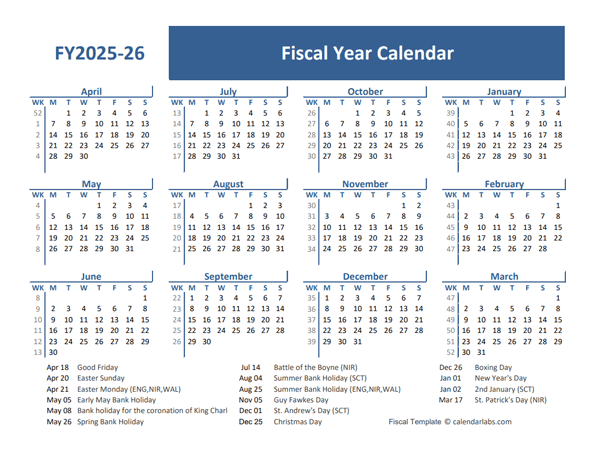

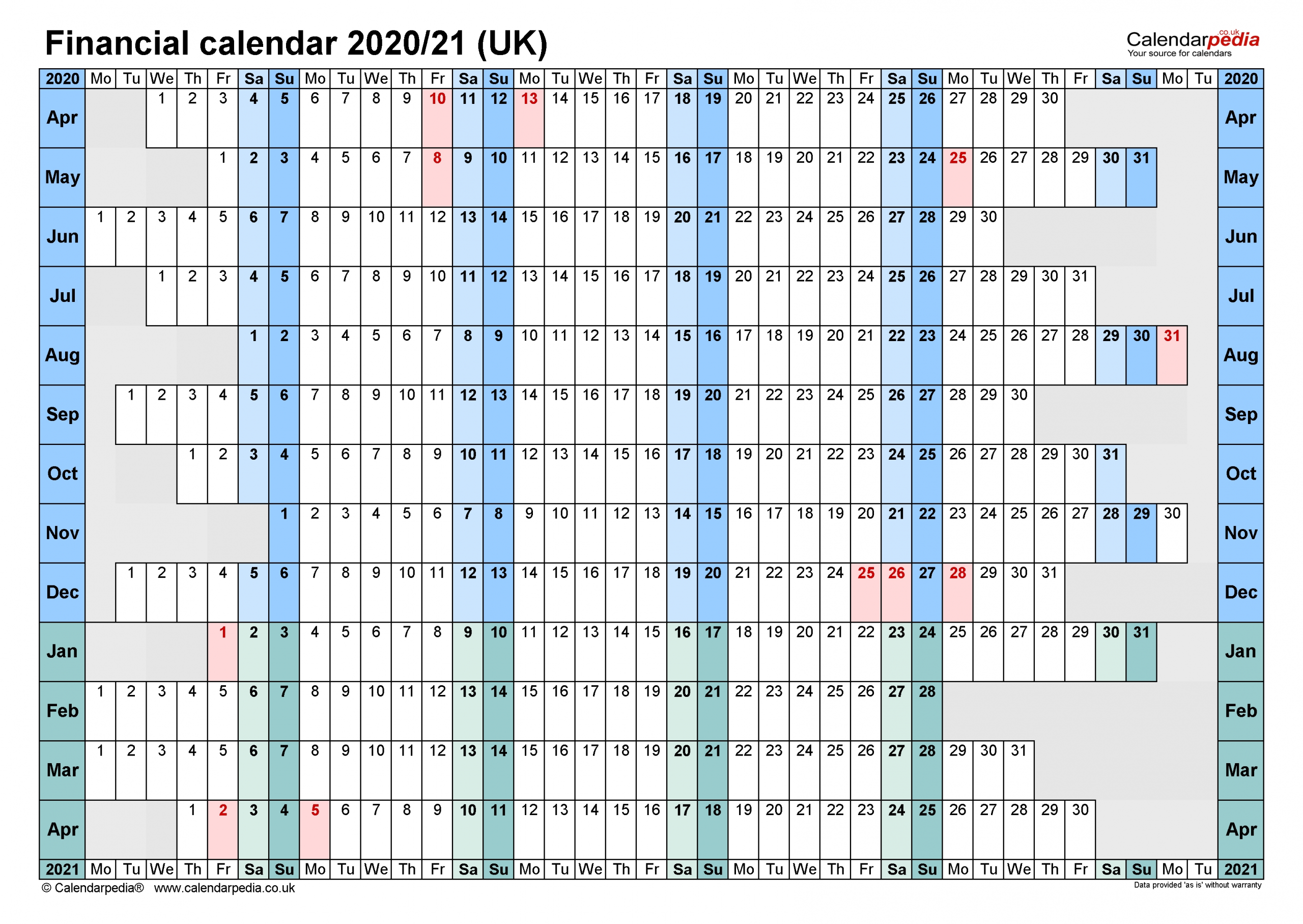

The UK financial year (FY) differs significantly from the Gregorian calendar, running from 1 April to 31 March. Understanding this distinction is crucial for businesses, accountants, and individuals alike, impacting tax filings, budgeting, and financial reporting. This comprehensive guide delves into the intricacies of the UK financial year 2025 (FY2025), offering insights into key dates, implications, and practical advice for effective financial management.

FY2025: Key Dates and Deadlines

FY2025 commences on 1 April 2024 and concludes on 31 March 2025. While the entire year is relevant for financial planning, certain dates hold particular significance for tax obligations and reporting requirements:

-

Corporation Tax: The deadline for filing corporation tax returns and paying the tax liability varies depending on the company’s accounting period. Companies with accounting periods ending on 31 March 2025 will have a specific deadline, often falling several months after the year-end. It’s crucial to check HMRC guidelines for precise deadlines based on individual circumstances. Penalties for late filing and payment are substantial, so meticulous planning is vital.

-

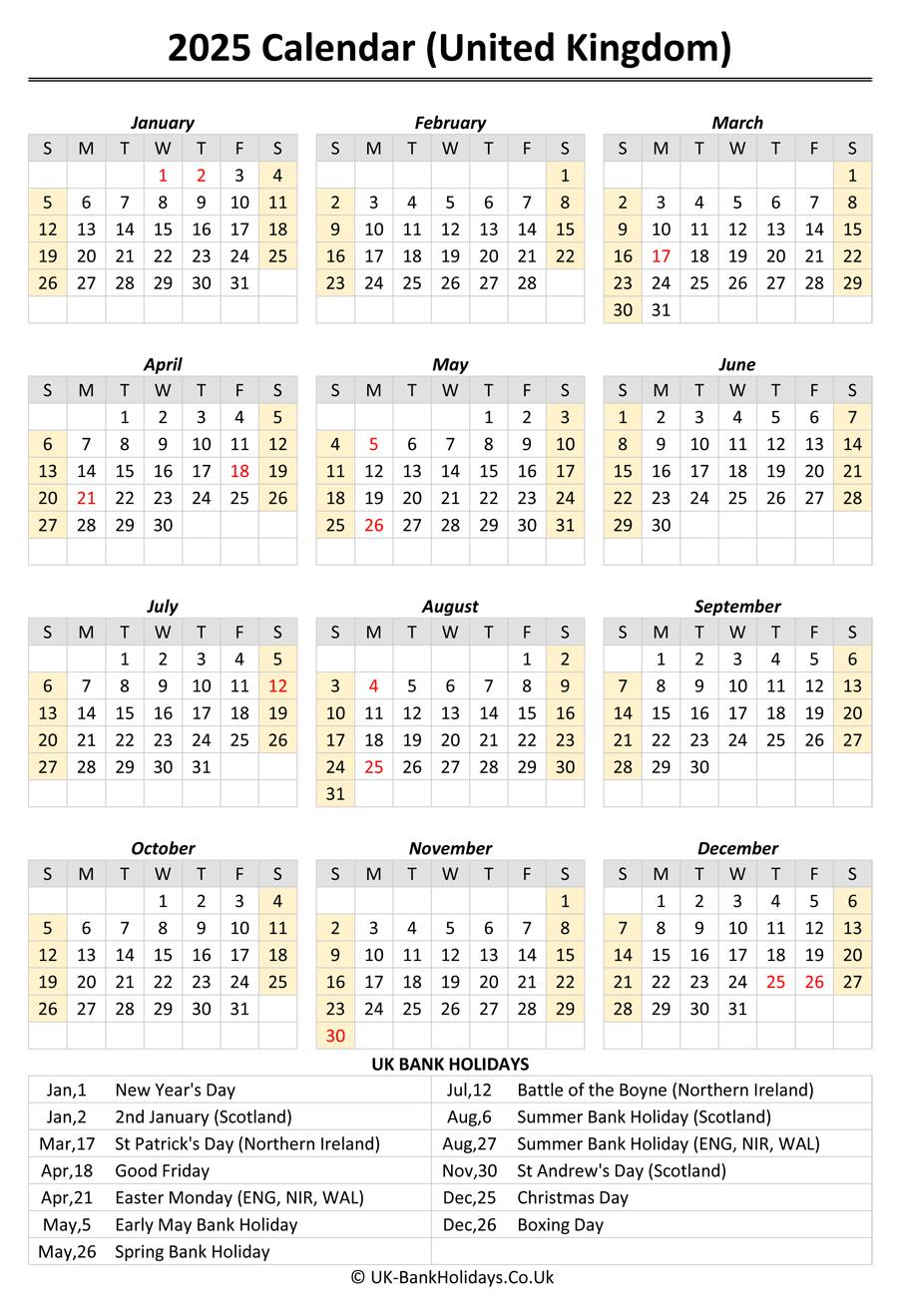

Income Tax (Self-Assessment): For self-employed individuals and those with untaxed income, the self-assessment tax return deadline is typically 31 January following the tax year. Therefore, for FY2025, the deadline will be 31 January 2026. This includes reporting income earned between 6 April 2024 and 5 April 2025. Again, prompt submission is crucial to avoid penalties.

-

VAT Returns: Value Added Tax (VAT) return deadlines depend on the business’s chosen VAT payment scheme. Quarterly returns are common, with deadlines typically one month and a half after the end of each quarter. Businesses must adhere strictly to these deadlines to maintain compliance and avoid penalties.

-

PAYE (Pay As You Earn): Employers are responsible for deducting income tax and National Insurance contributions from their employees’ salaries and remitting these to HMRC. PAYE operates on a regular basis (usually monthly or weekly), irrespective of the financial year. However, understanding the FY is important for annual reconciliation and reporting.

-

Other Tax Obligations: Depending on specific circumstances, individuals and businesses may face other tax obligations, including Capital Gains Tax, Inheritance Tax, and Stamp Duty Land Tax. The deadlines for these vary, and it’s vital to consult HMRC guidance or a tax professional for accurate information.

Planning for FY2025: A Proactive Approach

Effective financial management requires proactive planning, particularly in the context of the UK’s financial year. Here are some key strategies to consider:

-

Budgeting and Forecasting: Develop a comprehensive budget for FY2025 early in the year. This involves projecting income and expenses, considering potential fluctuations and unforeseen circumstances. Regular monitoring and adjustments are crucial to stay on track.

-

Cash Flow Management: Maintain a close watch on cash flow throughout the year. Anticipate periods of high expenditure and ensure sufficient liquidity to meet obligations. This might involve securing lines of credit or exploring other financing options.

-

Tax Planning: Engage with a qualified accountant or tax advisor to optimize tax planning strategies. This could involve claiming allowable expenses, making tax-efficient investments, or exploring other avenues for reducing tax liabilities. Proactive tax planning can significantly impact your bottom line.

-

Investment Strategies: Review and adjust investment portfolios to align with your financial goals and risk tolerance. Consider factors such as market conditions, inflation, and potential tax implications.

-

Record Keeping: Maintain meticulous financial records throughout the year. This includes invoices, receipts, bank statements, and other relevant documentation. Accurate record-keeping is essential for accurate tax filings and financial reporting.

Impact of FY2025 on Businesses

The UK financial year has significant implications for businesses of all sizes:

-

Financial Reporting: Companies prepare annual financial statements at the end of their financial year. These statements, including the profit and loss account and balance sheet, are crucial for internal decision-making and external reporting to stakeholders.

-

Auditing: Many businesses undergo an annual audit to ensure the accuracy and reliability of their financial statements. The audit process typically takes place after the year-end.

-

Performance Evaluation: The financial year provides a framework for evaluating business performance. Key performance indicators (KPIs) are tracked throughout the year, and the year-end provides an opportunity for a comprehensive assessment.

-

Strategic Planning: The financial year aligns with the business’s strategic planning cycle. Year-end provides an opportunity to review past performance, set new goals, and develop strategies for the upcoming year.

-

Investor Relations: Publicly listed companies use the financial year to report their financial performance to investors. This involves releasing annual reports and holding investor meetings.

Challenges and Opportunities in FY2025

FY2025 presents both challenges and opportunities for individuals and businesses:

-

Economic Uncertainty: Global economic conditions and potential fluctuations in the UK economy pose challenges to financial planning. Businesses need to be adaptable and resilient to navigate economic uncertainties.

-

Inflation: High inflation rates can impact both income and expenses. Businesses need to adjust pricing strategies and manage costs effectively to maintain profitability.

-

Technological Advancements: Technological advancements offer opportunities to improve financial management processes. Embracing new technologies can enhance efficiency, accuracy, and decision-making.

-

Government Policies: Changes in government policies, including tax regulations, can significantly impact businesses and individuals. Staying informed about relevant policy changes is crucial for effective financial planning.

Conclusion:

The UK financial year 2025, running from 1 April 2024 to 31 March 2025, presents a crucial period for financial planning and management. Understanding key dates, deadlines, and potential challenges is essential for individuals and businesses alike. Proactive planning, meticulous record-keeping, and seeking professional advice when necessary are crucial for navigating the complexities of the UK financial year successfully. By implementing effective strategies and staying informed about relevant changes, individuals and businesses can optimize their financial performance and achieve their objectives throughout FY2025 and beyond. Remember to always consult official HMRC resources and seek professional advice tailored to your specific circumstances for the most accurate and up-to-date information.